In the second half of July, purchase prices rose due to a raw milk deficit and high export demand for commodities. Butter exports increased by 50% in the first half of the year, and the hryvnia's devaluation is stimulating price growth for finished products. Further increases in purchase prices are expected in early August, but there are risks of them falling in the second half of the month due to uncertainty with EU trade after the cancellation of ATMs. New quotas have not yet been approved due to resistance from Central and Eastern European countries, which could halt Ukrainian dairy exports, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

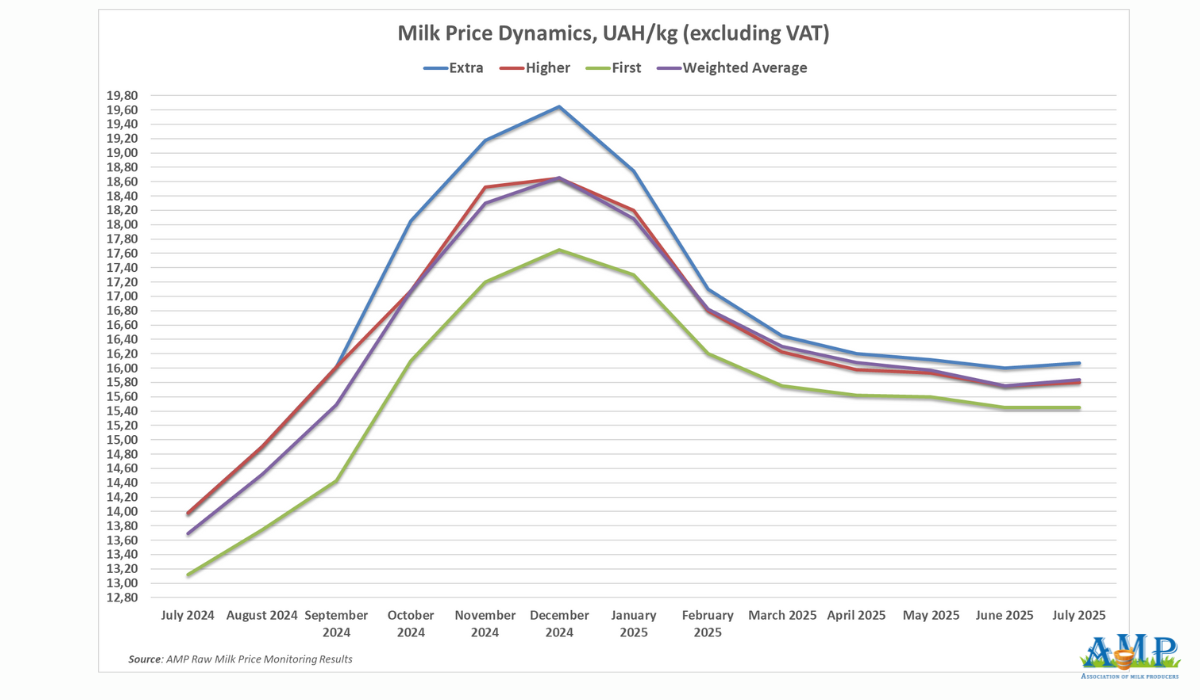

The average purchase price for extra grade milk as of July 22 was 16.14 UAH/kg excluding VAT, which is 14 kopiykas more than a month ago. The price range for this grade on farms varies from 15.50 to 16.70 UAH/kg excluding VAT. The upper limit of the price range increased by 20 kopiykas.

Higher grade milk costs on average 15.85 UAH/kg excluding VAT (+10 kopiykas). Prices for Higher grade milk ranged from 15.30 to 16.35 UAH/kg excluding VAT. The upper limit of the price range increased by 15 kopiykas.

The average price for First grade milk was 15.45 UAH/kg excluding VAT and remained unchanged from the second half of last month. The minimum price on farms was 15.00 UAH/kg. The maximum price was 15.60 UAH/kg. The lower and upper limits of the price range remained unchanged.

Accordingly, the weighted average price for all three grades was 15.92 UAH/kg excluding VAT, which is 12 kopiykas more compared to the results of the previous monitoring.

Georghii Kukhaleishvili notes that the increase in purchase prices in the second half of July was facilitated by a raw milk deficit in the domestic market, as well as high demand for commodities in export markets. In June, Ukraine increased casein exports, and butter exports in the first half of 2025 grew by 50%. Prices for finished products are rising under the influence of the hryvnia's devaluation. The profitability of producing milk powder, casein, and cheese products has improved. A price increase of 20-30 kopiykas for raw milk is likely in early August, considering its deficit in Ukraine and producers' desire to increase revenue from dairy product sales while there is active demand for commodities in foreign markets.

However, there are risks of further reductions in purchase prices due to ambiguous prospects for dairy product exports to the EU. After the European Commission canceled autonomous trade measures (ATMs) in June, Ukraine and the EU revised the trade agreement, agreeing on new quotas for Ukrainian dairy product exports, with a gradual transition to EU standards by 2028. Nevertheless, the new document has still not been signed due to the position of Hungary, Poland, Romania, Bulgaria, and Slovakia regarding tariffs and quotas for Ukrainian grain, which are also included in the agreement. There is a risk of suspending dairy product exports from Ukraine to the EU next month if the new terms do not come into effect soon. It is likely that the existing EU quotas for butter and milk powder will last until the end of August, while supplying goods with tariffs is not profitable for Ukrainian exporters.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News