Ukraine continues to increase its dairy product exports thanks to high global prices for exchange-traded commodities. Ukraine and the EU are seeking a solution to ensure the uninterrupted export of domestic agricultural products to the European market after the trade preferences expire on June 5, 2025, reports Georghii Kukhaleishvili, an analyst at the Association of Milk Producers (AMP).

According to preliminary data from the State Statistics Service of Ukraine (SSSU), in May 2025, 14.88 thousand tonnes of dairy products were exported, totaling 50.83 million USD. Compared to April, natural export volumes increased by 25%, and compared to May 2024, they grew by 14%. Export revenue increased by 32% relative to April and by 48% relative to May 2024. In January-May 2025, Ukraine exported 57.97 thousand tonnes (+17%) of dairy products for a total of 179.32 million USD (+57%).

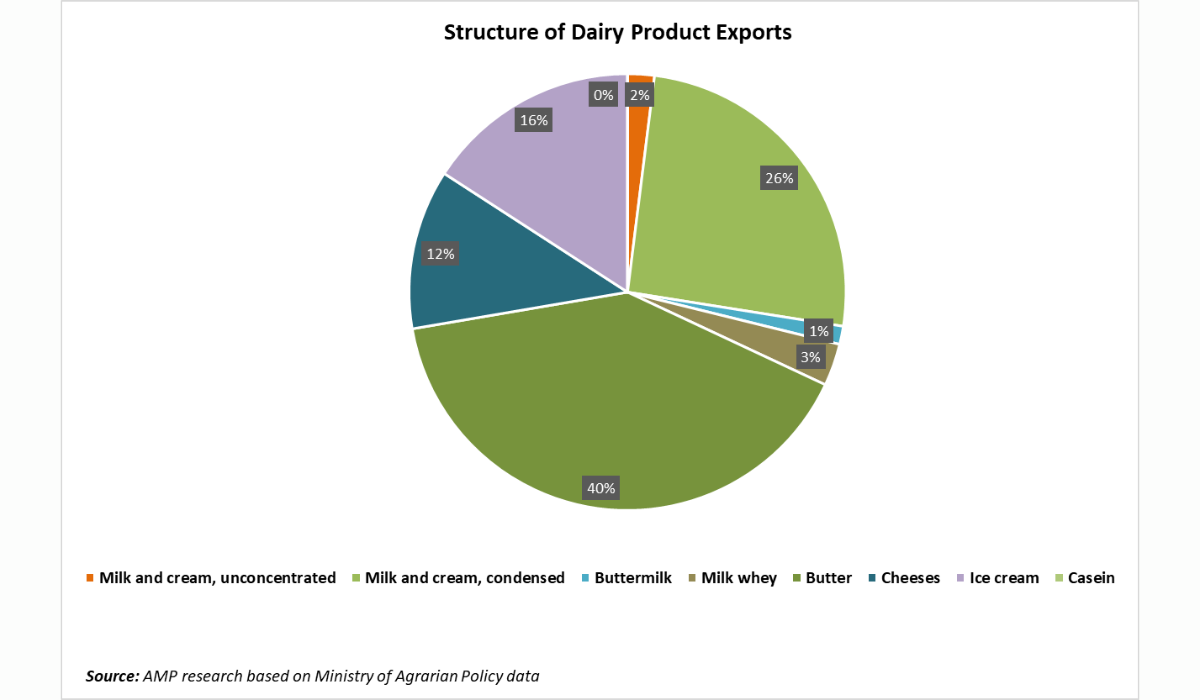

The main export categories in April were the following goods:

- Butter – 40%;

- Milk and cream, condensed – 26%;

- Ice cream – 16%;

- Cheeses – 12%.

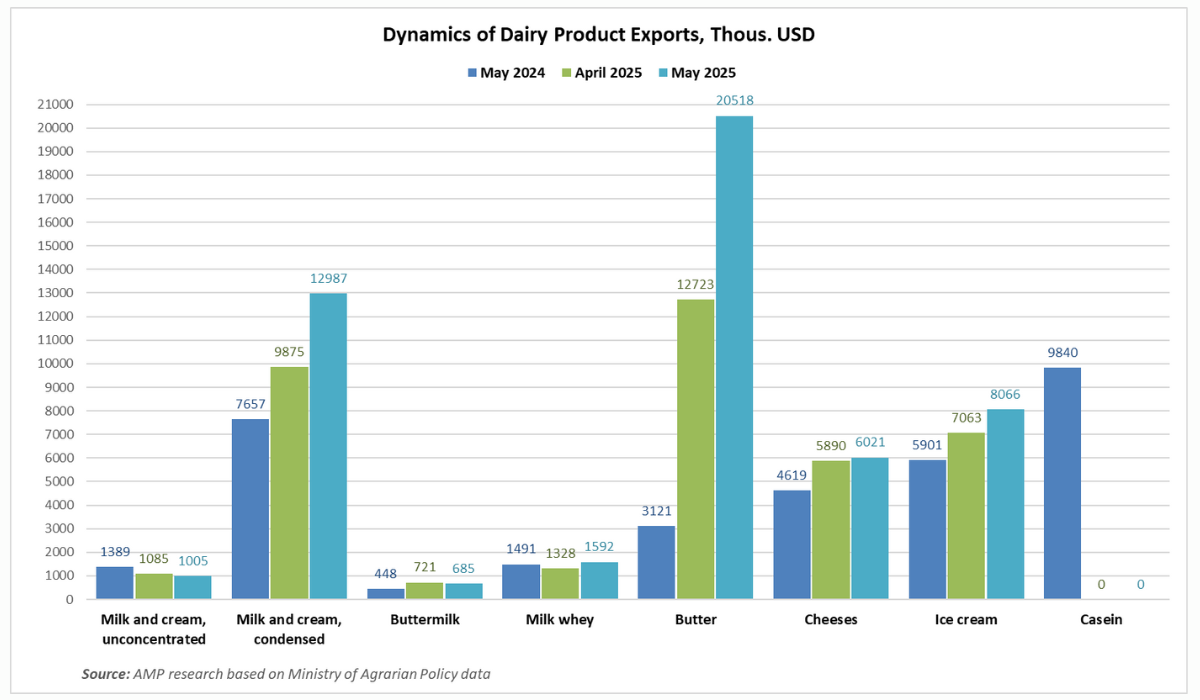

In May 2025, Ukraine increased natural export volumes of buttermilk to 500 tonnes (+5%), butter to 2.89 thousand tonnes (+61%), cheeses to 1.29 thousand tonnes (+2%), ice cream to 2.24 thousand tonnes (+18%), milk whey to 1.70 thousand tonnes (+19%), and milk and cream, condensed to 5.04 thousand tonnes (+31%) relative to April. Only the volumes of milk and cream, unconcentrated decreased to 1.19 thousand tonnes (-2%) relative to April of the current year. Compared to May 2024, only natural export volumes of milk and cream, unconcentrated (-45%) and milk whey (-26%) decreased. The largest increases in deliveries to foreign markets were for butter (+464%), and exports of milk and cream, condensed (+58%), buttermilk (+51%), cheeses (+22%), and ice cream (+25%) also increased compared to the same period last year.

Compared to April 2025, revenue increased for shipped milk and cream, condensed to 12.98 million USD (+32%), butter to 20.51 million USD (+61%), cheeses to 6.02 million USD (+2%), and ice cream to 8.06 million USD (+14%). Revenue decreased for exported milk and cream, unconcentrated to 1 million USD (-7%) and buttermilk to 685 thousand USD (-5%). Compared to May 2024, revenue increased for exported milk and cream, condensed (+70%), buttermilk (+53%), butter (+557%), cheeses (+30%), ice cream (+37%), and milk whey (+7%), but decreased for supplied milk and cream, unconcentrated (-28%).

In January-May 2025, Ukraine increased natural export volumes of milk and cream, condensed to 18.34 thousand tonnes (+55%), buttermilk to 2.25 thousand tonnes (+41%), butter to 7.85 thousand tonnes (+314%), cheeses to 5.74 thousand tonnes (+23%), and ice cream to 7.02 thousand tonnes (+28%) relative to January-May 2024. Compared to the same period last year, export volumes decreased for milk and cream, unconcentrated to 7.67 thousand tonnes (-33%), milk whey to 7.92 thousand tonnes (-17%), and casein to 1.14 thousand tonnes (-61%).

Revenue in January-May 2025 increased for exported milk and cream, condensed to 46.89 million USD (+55%), buttermilk to 3.28 million USD (+56%), milk whey to 7.30 million USD (+15%), butter to 56.24 million USD (+368%), cheeses to 26.61 million USD (+31%), and ice cream to 25.38 million USD (+38%) relative to the same period last year. Compared to January-May 2024, revenue decreased for exported milk and cream, unconcentrated to 6.07 million USD (-17%) and casein to 7.52 million USD (-57%).

Georghii Kukhaleishvili notes that high global prices for exchange-traded commodities contribute to Ukraine's increased dairy exports. Specifically, the price of butter in the EU remains at 7200–7400 euros per tonne, which are near-record figures not recorded since 2017–2018. In comparison, skimmed milk powder appears cheaper but remains within average historical values. European traders purchased Ukrainian dairy products in the quantities they needed, taking advantage of the fact that butter and skimmed milk powder in Ukraine cost less than in Europe.

Milk processing enterprises are likely ready to export even more dairy products, but a certain barrier has been the uncertainty surrounding autonomous trade measures (ATMs) for milk and dairy products from Ukraine, which since 2022 allowed domestic processing enterprises to supply their products to the EU without quotas and duties. Under pressure from farmers and politicians from Poland and France, the European Commission had planned to reinstate duties and quotas on Ukrainian agricultural products, which was expected to contribute to a reduction in dairy product exports from Ukraine to the EU.

However, the government of Ukraine and the European Commission are seeking a solution that will ensure the uninterrupted export of agricultural products to the EU after the trade preferences expire on June 5, 2025. The parties are working on establishing a sustainable cooperation format by the end of July. Ukraine and the EU are preparing for new trade negotiations, which involve adapting to the norms of the Association Agreement and gradual integration into the European market.

The increase in raw material supply in Ukraine and weak domestic demand create conditions for increasing exports. The export of exchange-traded commodities (skimmed milk powder, whey, butter) is growing most significantly due to B2B deliveries, resales to third countries by traders from Poland and the Netherlands, and renewed demand for dairy products in Bulgaria and Romania. In addition, exports of finished products – condensed milk, cheeses, and private label products – to Germany, Lithuania, and Moldova are also growing.

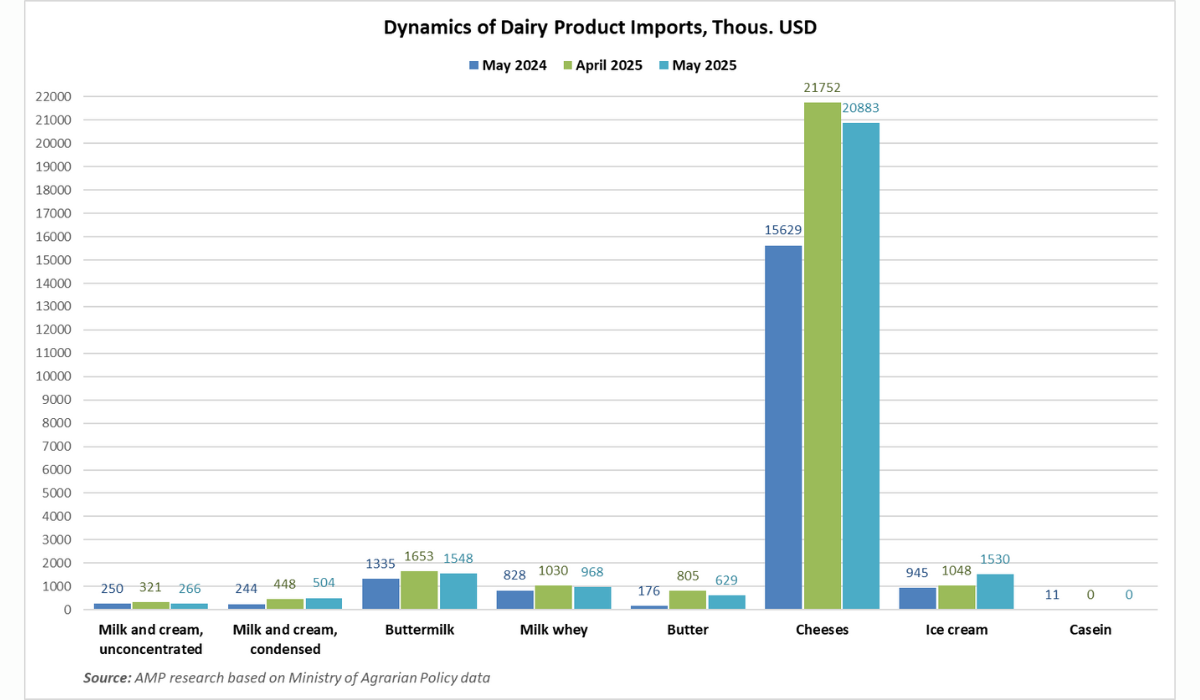

In May 2025, Ukraine imported 5.05 thousand tonnes of dairy products totaling 26.32 thousand USD. Compared to April 2025, natural import volumes decreased by 2%, but increased by 18% relative to May 2024. In January-May 2025, Ukraine imported 25.61 thousand tonnes (+11%) of dairy products totaling 128.63 million USD (+14%). The largest share of total imports belongs to cheeses (64%).

The share of imported cheeses in the domestic market reached 47%. The increased supply and consumption of imported cheeses in Ukraine complicates the sale of domestic cheesemakers' products in the domestic market and puts pressure on raw milk prices. Limiting the import of Polish cheeses into Ukraine and increasing cashback by 30% for buyers of domestically produced cheeses could stabilize raw milk prices. However, the implementation of these measures is unlikely due to the position of the Ministry of Economy and unwillingness to worsen relations with Poland, which is considered a strategic partner of Ukraine in the defense sector.

The foreign trade balance in May was positive, amounting to 24.54 million USD.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News