Surpluses of raw milk and finished products are putting pressure on procurement prices. A certain price stabilization is expected in the 3rd-4th quarter of 2026, according to Georghii Kukhaleishvili, analyst at the Association of Milk Producers (AMP).

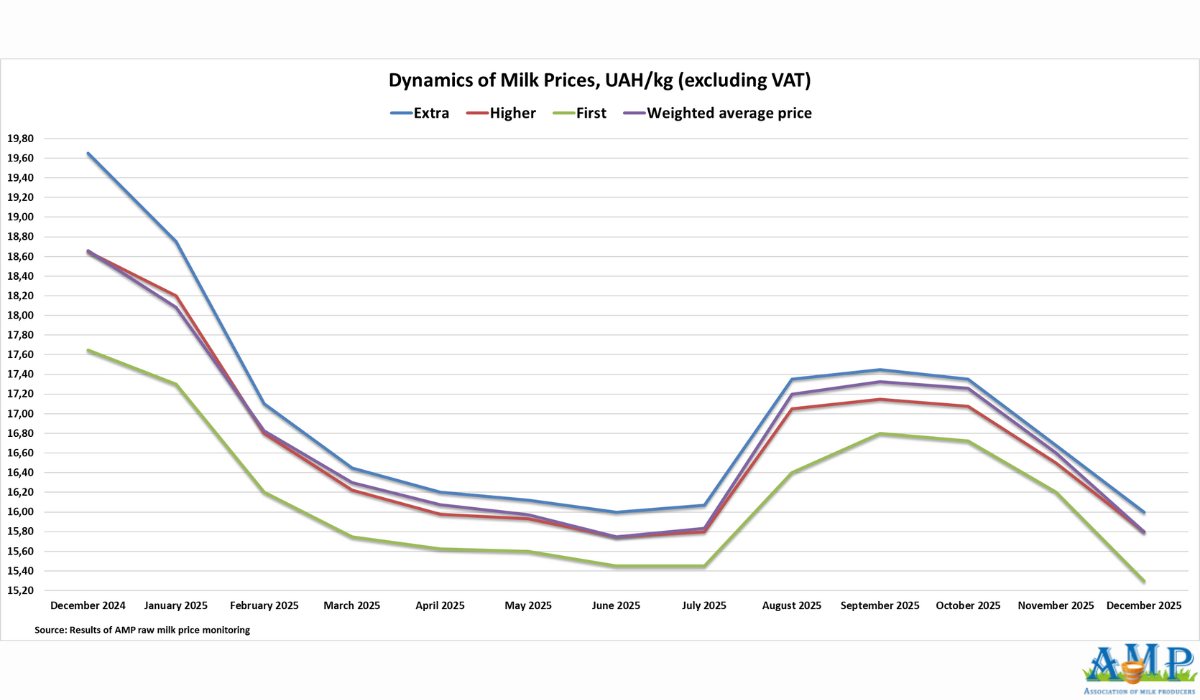

The average procurement price for Extra grade milk as of December 9 was 16.00 UAH/kg (excluding VAT), which is 1.05 UAH less than the previous month. The price range for this grade in farms varies from 15.60 to 16.30 UAH/kg (excluding VAT). The lower price range decreased by 90 kopecks, and the upper range by 1.20 UAH.

Higher grade milk costs an average of 15.80 UAH/kg (excluding VAT), which is 1.10 UAH lower than the previous month. Higher grade milk prices fluctuate from 15.10 to 16.00 UAH/kg (excluding VAT). The lower price range decreased by 1.40 UAH, and the upper range by 1.10 UAH.

The average price for First grade milk was 15.30 UAH/kg (excluding VAT), which is 1.20 UAH less than the previous month. The minimum price in farms was 15.00 UAH/kg. The maximum price was 15.50 UAH/kg. The lower price range decreased by 1.50 UAH, and the upper range decreased by 1.20 UAH.

Accordingly, the weighted average price of the three grades was 15.80 UAH/kg (excluding VAT), which is 1.15 UAH less than the previous month.

Georghii Kukhaleishvili notes that the decline in procurement prices continues in Ukraine. Stocks of finished products in warehouses and the influx of cheap imported dairy products into the country will continue to put pressure on the prices of raw milk. Typically, a lull is observed in the dairy market after December 25, as export volumes of commodity goods and sales volumes of dairy products in the domestic market decrease during the New Year holidays. A drop in the profitability of butter and milk powder production is observed in Ukraine. It is likely that low raw milk prices may persist throughout the first quarter of 2026.

The global dairy market has surpluses of raw milk and finished products, and existing demand is not managing to absorb them, which also affects the price trend in Ukraine. Milk production in most producing regions in 2024–2025 grew faster than consumption. Milk supply turned out to be higher than expected, creating surpluses of dairy fat and protein. Among the reasons that encouraged farmers to increase milk yields were cheaper feed, lower energy costs, improved weather conditions, the absence of strong regulatory pressure in the US and parts of Latin America, and the preservation of stable cow productivity in the EU despite voluntary herd reduction in some member states.

Given the unstable situation in the global dairy market, many milk processing enterprises in 2024–2025 reoriented themselves towards the production of long-shelf-life products, such as hard cheeses, butter, and dry milk products. Specifically, cheese was the main processing direction in the US and the EU, while the share of butter and skim milk powder production increased in New Zealand and Uruguay. Processors aimed to convert the milk surplus into long-term stocks, but global demand grew slower than expected.

After the inflationary pressure of 2022–2023, consumer demand for fatty dairy products in the EU and the US recovered slowly. Consumption of butter and cheese decreased in the EU's hotel and restaurant business, in food service enterprises, and in households, due to tariff increases by the Trump administration. In the US, cheese sales in supermarkets declined due to reduced purchasing power of the population. The use of butter in processing decreased. China and Southeast Asian countries reduced dairy product imports due to large domestic inventories and weak economic activity. Therefore, a significant surplus of dairy products emerged globally. It is likely that inventories will normalize in the 3rd–4th quarter of 2026 due to reduced milk yield volumes in the US and the EU amid falling farmer profits.

It is likely that raw milk production in Ukraine in 2026 may decrease to 6.8 million tonnes due to a further 10% reduction in milk yield in the private sector, the suspension of milk production growth on farms, and the closure of certain farms with herds up to 400 head, as well as cost optimization and productivity increases on farms with herds greater than 600 head. The probable average annual milk price in 2026 in Ukraine may be 35 euro per 100 kg, while in the EU it may be 45 euro per 100 kg, and in the US – 32.5 euro per 100 kg.

Press Service of the Association of Milk Producers

Follow us on LinkedIn

Related News