According to the results of the GDT trading session, there was a slight decrease in the price index amid falling prices for Cheddar and lactose, and weaker quotes for butter and milk powder, according to Georghii Kukhaleishvili, an analyst at the Association of Milk Producers.

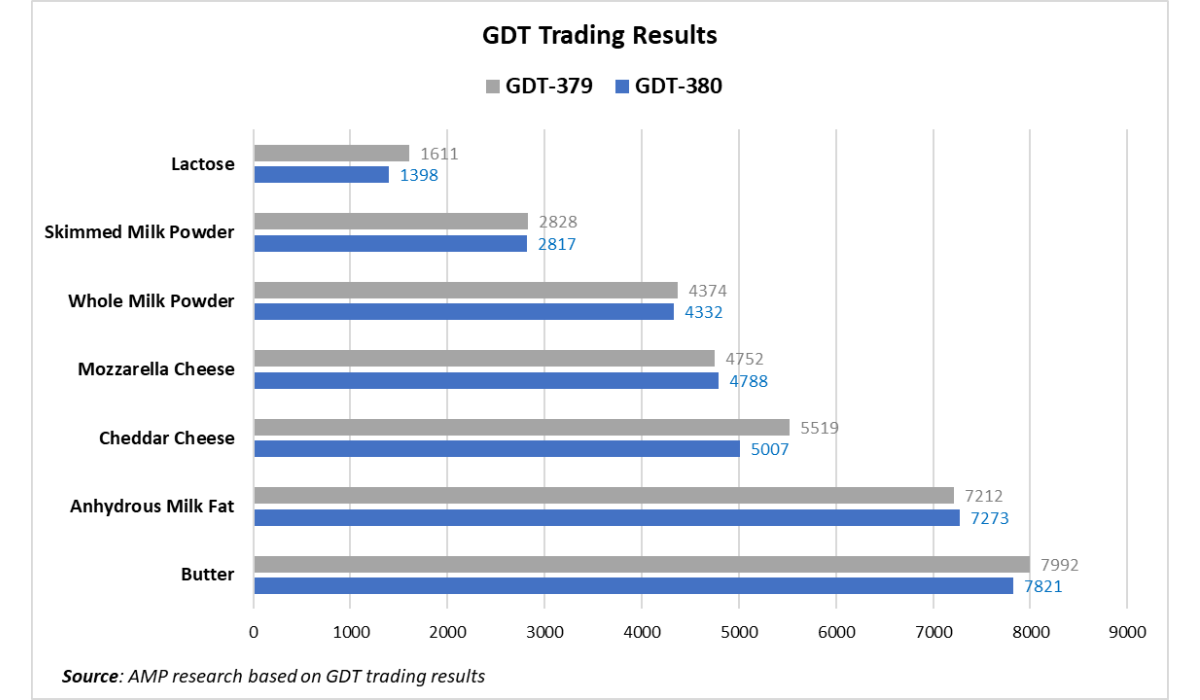

On Tuesday, May 20, the 380th GDT trading session took place, the results of which showed the price index at 1333, a decrease of 11 points (-0.9%) since the previous auction. The average price for dairy products was USD 4589 per tonne, which is USD 73 more than the results of the previous trading session. During the trading, 15194 tonnes of exchange-traded goods were sold, which is 1520 tonnes less than the results of the last auction. The minimum offer was recorded at 14891 tonnes, and the maximum at 19016 tonnes. 177 dairy market operators participated in the trading, which is 2 more companies compared to May 6.

According to the trading results, the price of anhydrous milk fat was USD 7273 per tonne, which is 0.9% more than the previous trading session. According to the Food Production Solutions Association, anhydrous milk fat may enjoy sufficient demand in developing country markets due to its more affordable price compared to butter. According to IMARC Group, the global anhydrous milk fat market reached USD 3.1 billion in 2024. IMARC Group forecasts that the market volume may increase to USD 5.3 billion by 2033, which would mean an annual growth of 6.2% in the period from 2025 to 2033. According to Future Market Insights, Fonterra and Dairy Farmers of America are expanding their production capacities to meet the dairy fat needs of developed and developing countries.

However, the US trade war against Mexico complicates the situation in the global anhydrous milk fat market. According to Dairy News Today, Mexico imports this product from New Zealand for further re-export to the United States. After the introduction of 25% tariffs on goods from Mexico and Canada by US President Donald Trump's administration, doubts arose about further supplies of anhydrous milk fat to America. The loss of access to the American market may restrain demand for the product. Mexico buys about 10% of the anhydrous milk fat produced by New Zealand. According to an OCER forecast, American tariffs could lead to an economic downturn in Mexico, which is likely to negatively affect the demand for dairy products in the country's domestic market. Auction organizers predict an increase in the price of anhydrous milk fat by 1.1% in June and by 0.2% in July.

The price of butter at this trading session was USD 7821 per tonne, which is 1.5% less compared to the results of the previous auction. According to the USDA, in the US, the supply of raw milk remains large despite a certain reduction in milk yield in some states and despite the existing demand for cream from ice cream producers. American butter producers are working for stock and building up inventories for the winter. Demand for butter is quite active both in the US domestic market and in export markets. In Europe, despite the seasonal increase in milk yield, butter production volumes are lower than last year, and product stocks are not too large.

In Oceania, demand for butter outstrips supply, and production volumes are declining amid lower milk yield. Although, as noted by analyst Rob Hamlin from the University of Otago, the price of butter in Costco supermarkets is almost equal to Fonterra's wholesale price for raw milk, and no retailer can compete with it. The butter is supplied by Westland Milk Products, which belongs to the Chinese Yili Group. It is likely that Yili is dumping prices to earn a margin on bulk sales of butter. Analyst Chris Wilkinson believes that Costco achieves low prices through large packaging and bulk purchases. According to reviewer Chris Schultz, the low price attracts buyers and creates a positive image compared to other supermarkets. Fonterra added that the company is trying to restrain price growth. According to the GDT organizers' forecast, butter prices may decrease by 1.9% in June and by 1.7% in July.

The price of whole milk powder was USD 4332 per tonne and decreased by 1% compared to the results of the previous trading session. According to the USDA, in the US and Europe, demand for whole milk powder is limited to the fulfillment of current contractual obligations. The strengthening of the euro does not favor the competitiveness of European whole milk powder in export markets. A likely reason for the decline in milk powder prices is the recent changes in the Chinese government's policy. Since May 2025, drinking milk in China can only be produced from raw milk. The Chinese government banned the reconstitution of drinking milk from milk powder to protect the interests of national producers amid an economic slowdown, falling raw milk prices, a deterioration in living standards in China, and reduced consumption of dairy products in the domestic market. According to the GDT forecast, a likely decrease in the price of whole milk powder by 1.2% in June and by 2% in July.

Skimmed milk powder decreased slightly to USD 2817 per tonne (-0.7%). According to the USDA, demand for the product is stable in Europe and the US. Demand for skimmed milk powder produced in Argentina and Uruguay is active from Algeria and Brazil. There is an increase in demand for American-made skimmed milk powder in export markets, particularly in Mexico. Prices were not pushed up even by the seasonal reduction in skimmed milk powder production in Oceania. Most likely, prices for the product are being restrained by China's abandonment of the practice of reconstituting drinking milk from milk powder, which may lead to a reduction in the country's import volumes. GDT organizers expect a decrease in the price of skimmed milk powder by 1.8% in June and by 0.1% in July.

Cheddar cheese decreased to USD 5007 per tonne (-9.2%), while Mozzarella cheese increased only to USD 4788 per tonne (+0.7%). According to the USDA, taking advantage of a sufficient supply of raw milk, American cheesemakers are increasing production volumes. In the US domestic market, demand for cheeses from the food industry is slowing down, but sales of hard and processed cheeses in supermarkets have increased. According to Dairy Herd, cheese prices in the US spot market fell at the beginning of the week. American cheeses are price-competitive in export markets.

In Europe, demand for cheeses is stable. The most active sales are in Southern European countries. Warehouse stocks of cheeses are limited, but sufficient to meet market needs. The trade war of US President Donald Trump's administration and the increase in tariffs on European dairy products create preconditions for lower cheese prices in Europe. Until recently, the US imported large volumes of cheeses from France, Italy, and Ireland. European dairy processing enterprises will not be able to quickly reorient the export directions of their products, which may put downward pressure on prices. Trade organizers assume that Cheddar cheese may decrease by 8.5% in June and in July. The price of Mozzarella cheese is forecast to increase by 0.3% in July.

Lactose decreased to USD 1398 per tonne (-13.2%). As reported by the USDA, the supply and stocks of lactose are limited in the spot market in the US, as most of the product volumes have already been contracted. Export demand for the product is expected to change. According to RaboResearch, China struck the US in the trade war by imposing a 34% tariff on imports of American lactose. The blow fell on the most vulnerable segment of American agricultural exports — dairy ingredients, more than half of which the US supplies to foreign markets, and where China is the largest buyer.

Against this background, the EU may gain a unique window of opportunity. According to RaboResearch, in 2024, the EU exported 274 thousand tonnes of lactose, of which 33 thousand tonnes went to China. In theory, European producers could cover part of the volumes that the US will lose. However, there is a nuance — European products are significantly more expensive. Even taking into account the new tariffs, the US retains a price advantage. GDT organizers predict a decrease in the price of the product by 13.2% in July.

The next GDT trading session will take place on June 3.

Press Service of the Association of Milk Producers

Follow us on Facebook

Related News